An Introduction to Taxes for Online Sellers

- 28 February 2018

- ByBig Cartel

- 7 min read

Tackling taxes can be intimidating, but understanding your tax responsibilities is important for the health of your business. Aside from just being a good citizen, getting it wrong (or not doing it at all!) can lead to serious problems down the line.

If you're not sure where to begin, we'll introduce you to the key areas for tracking your income and preparing to file your taxes if your business is based in the United States. But keep in mind, we're not tax professionals. When it's time to to file, it's best to confirm that everything's in order with a Certified Public Accountant (CPA), or even have them file your taxes for you. Whatever you decide to do, just remember: This is an introduction to taxes, not the final word.

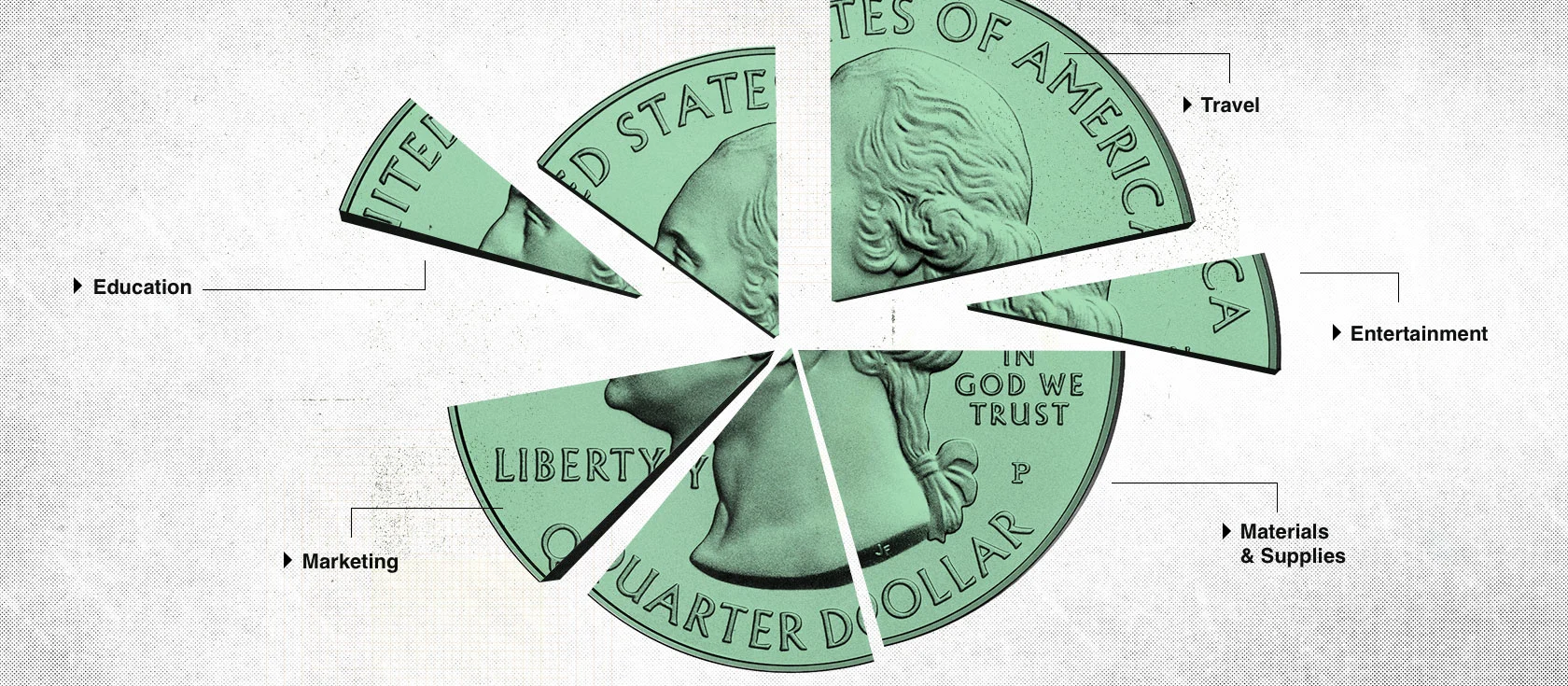

Organize Your Finances

Whether you plan to file your taxes or hire a professional, being organized is the most important thing you can do. Not only will you have a grasp on what money is coming and going, you won't have to stress at the last minute when you can't remember whether you saved a specific receipt or not.

Being organized comes down to two important steps:

Set up a separate bank account.

Keep accounting records.

By opening a separate checking account at your bank of choice and devoting it solely to income and expenses related to your business, it'll be much easier to track your business expenses and file taxes when the time comes.

You might also want to consider linking a savings account to your new checking account, so you can save money from each paycheck for future tax payments. Although the amount differs depending on a lot of factors, it's not a bad idea to set aside 30-40% of your income for local, state, and federal taxes. (Why so much? As a self-employed person, you pay taxes both as the employer and employee.)

Along with paying taxes, your business is legally required to track your income and expenses. Accounting software like Quickbooks, Freshbooks, and Quicken (or even a well-organized spreadsheet) can help you keep everything in order.

Although it costs a little bit upfront, accounting software will save time and money when preparing your annual tax returns, so keep that in mind. Plus, you'll get a good snapshot of your business as you enter information over time, so you can make better decisions on which areas of your business are profitable or too expensive.

If you prefer to track everything digitally, pick up an app like Scanbot to quickly and easily save copies of receipts and other paperwork. (You should probably still file away the paperwork, just in case.)

Understand Your Tax Obligations

The United States Small Business Administration (SBA) has a great guide to help you understand your tax obligations. They break down the process into five steps:

Business or Hobby: Know where your shop stands and the advantages and requirements for each.

How to obtain a Tax ID: Learn if you need a federal Tax ID and where to get one.

Federal Tax: Find out what the federal tax obligations are for your shop.

State Tax: Understand the tax laws for businesses in your state and locality.

Understand your tax year: Mark your calendar with special filing requirements, including your tax year and when you need to file.

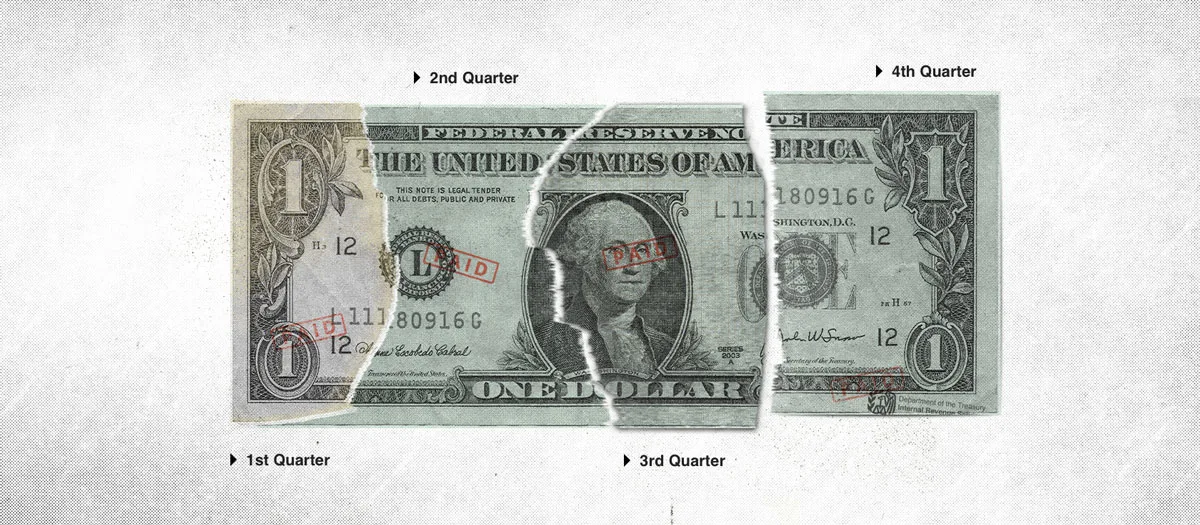

Quarterly Estimates and Annual Return

Once you're clear about which taxes you need to pay and how much they'll be, you'll need to make plans to file your taxes. Most people are aware that they need to pay taxes annually on or around April 15th. What you might not know, if you're a new entrepreneur, is that you may have quarterly tax requirements, too.

Filing quarterly can be more manageable - you'll be dividing what you owe into four smaller chunks, paid every three months. Filing an annual return will leave you with a more accurate total, but it's a bigger single payment to prepare for. Depending on your situation, you may not have an option on which route to go, so be sure you're clear on whether you need to file quarterly or not. And if you choose to file annually, you'll still need to submit a quarterly earnings estimate.

Quarterly estimated taxes can be calculated on a Form 1040-ES [PDF]. The instructions on that form will walk you through what kinds of income and expenses to include, how to calculate what you owe in a particular quarter, and where to send your payment.

More Resources

We're only scratching the surface here. Tax is a complex topic and chances are, at some stage, you'll need more help. Here are some tips for where to go next.

How to find a tax professional: The Internal Revenue Service (or IRS, the U.S. government agency responsible for tax collection and tax law enforcement) has some useful tips on how to find a tax professional. Here you'll find a helpful checklist to make sure you find someone you can trust, an idea of the information you'll need to provide, and how to avoid common pitfalls.

How the tax system effects small businesses: The IRS also provides resources through Small Business Taxes: The Virtual Workshop. (What a time to be online!) While all the lessons might not be relevant to you, we highly recommend checking out Lesson 1, which gives an overview of the tax system and the responsibilities for small businesses.

Getting everything set up properly to start can save you a lot of time as your business grows. It'll give you peace of mind and the freedom to focus more on doing what you love. Don't wait to get started on that paperwork! It only gets easier from here on out.

Helena Swyter of Sweeter CPA, Richard Laing, Anna Brozek, Dan Christofferson, and Andy Newman contributed to this guide.

28 February 2018

Words by:Big Cartel

Tags

- Share